Yorbeau Announces Receipt of Scheduled Option Payment of $750,000 From IAMGOLD in Order to Maintain Its Option on the Rouyn Property

Home » news-releases » news-releases-2021

![]() Download PDF version | View all documents on Sedar

Download PDF version | View all documents on Sedar

MONTREAL, Dec. 15, 2021 - Yorbeau Resources Inc. (TSX: YRB) (“Yorbeau” or the “Company”) is pleased to announce that in order to maintain its option to purchase a 100% interest in the Rouyn property, IAMGOLD Corporation (“IAMGOLD”) has made the next option cash payment to Yorbeau in the amount of $750,000 corresponding to the fourth in a series of scheduled cash payments to be made to Yorbeau during an Expenditure Period of 48 months.

The terms of the definitive option agreement were announced in the Company’s press release dated December 17, 2018. Among other commitments, IAMGOLD must make scheduled cash payments in an aggregate amount of C$4 million during the Expenditure Period. In the first three years, IAMGOLD has met and exceeded its expenditure obligation of C$6.5 million in exploration on the property. In 2022, IAMGOLD plans to continue the evaluation of the resource potential on the project and will complete an additional 6,000 metres of diamond drilling on selected zones of mineralization to support a future Mineral Resource Estimate. In 2022, IAMGOLD plans to continue the evaluation of the resource potential on the project and will complete an additional 6,000 metres of diamond drilling on selected zones of mineralization to support a future Mineral Resource Estimate.

G. Bodnar Jr., President of the Company, commented: “We are very pleased to continue to work with our exceptional partner IAMGOLD. This fourth payment reflects the satisfaction of our partner in the results obtained to date from infill and evaluation drilling programs. We are looking forward to resuming drilling activities in the coming year.”

About the Rouyn Gold Project

The Rouyn Gold Property is located about 4 km south of Rouyn-Noranda, Quebec. With a long history of mining, the city of Rouyn-Noranda offers many advantages for mining and exploration, including political and social stability, good access and infrastructure, skilled mining personnel, and one of the most mining-friendly jurisdictions in the world.

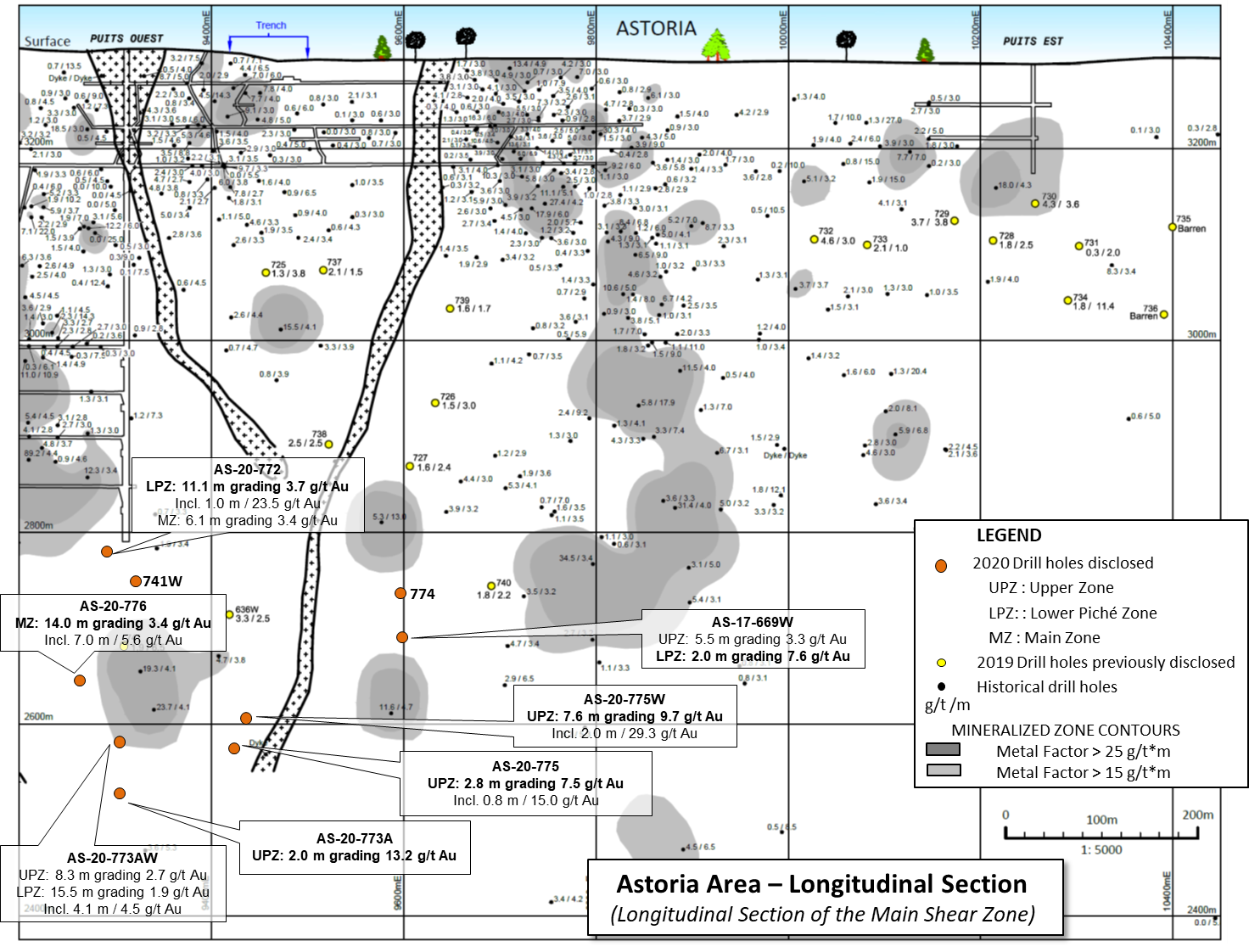

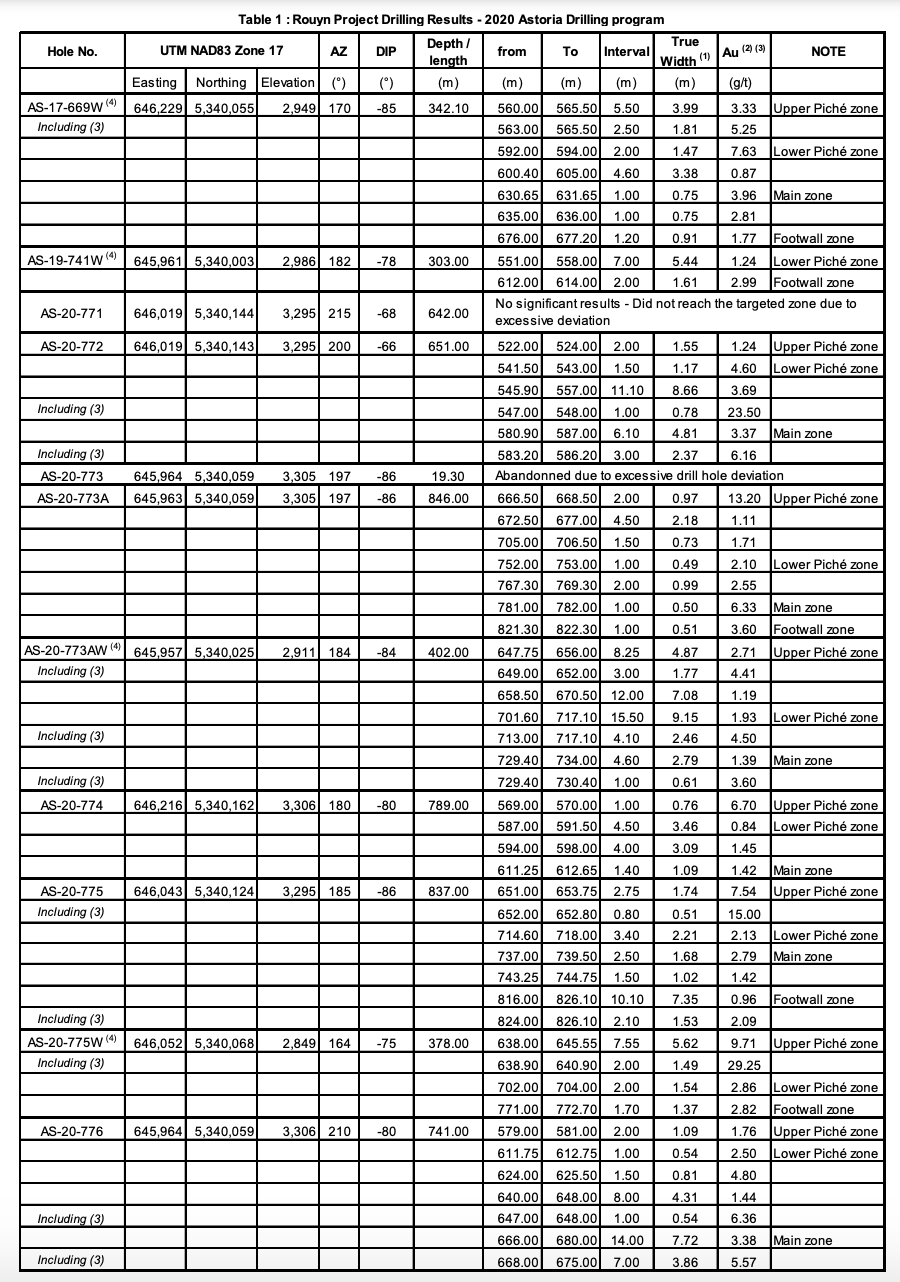

The property covers a 12-kilometre stretch of the Cadillac-Larder Lake Break and contains four known gold deposits along the 6-km Augmitto-Astoria corridor situated on the western portion of the property. Two of the four deposits, Astoria and Augmitto, benefit from established underground infrastructure and have been the subject of technical reports that include resource estimates that were previously filed in accordance with Regulation 43-101.

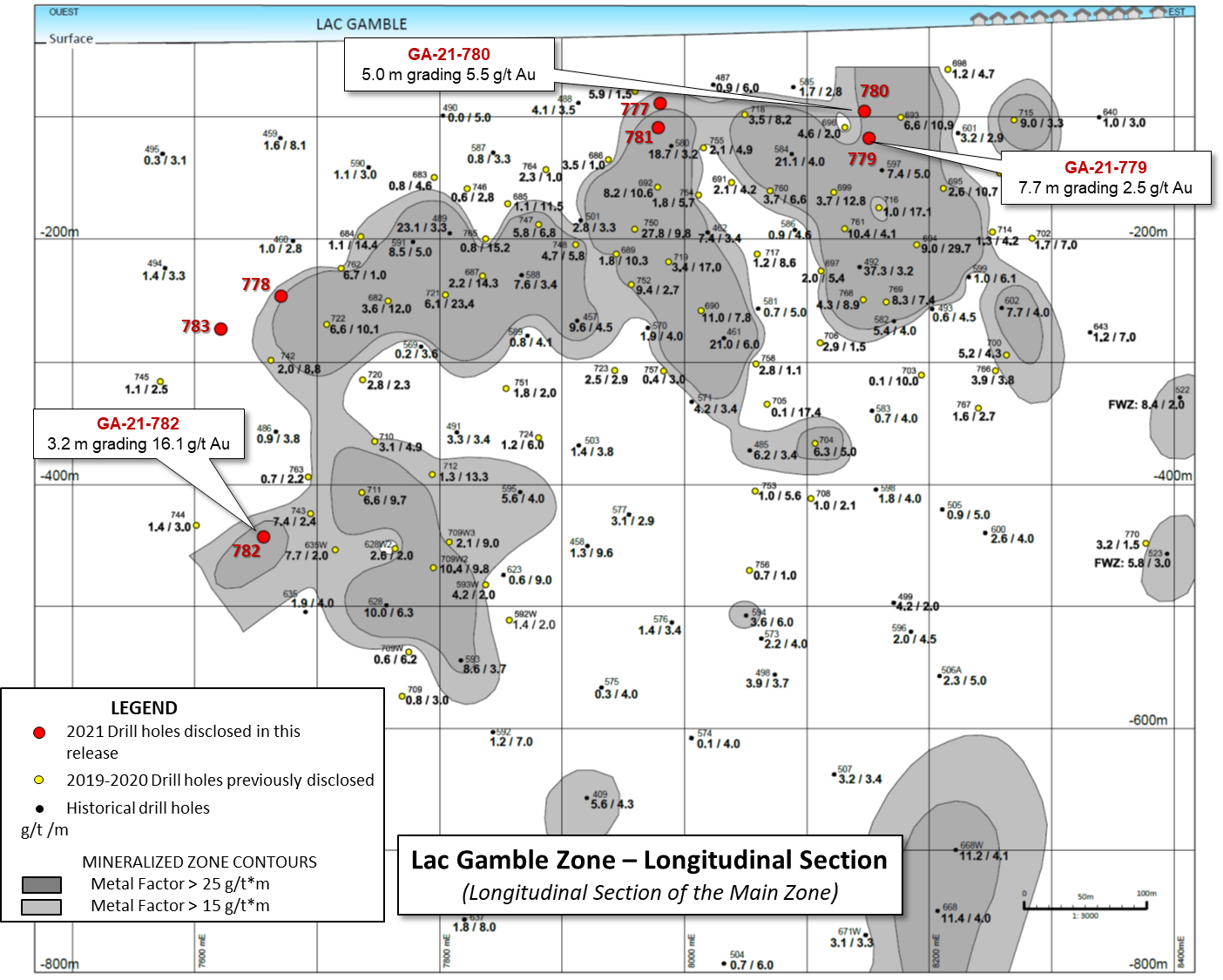

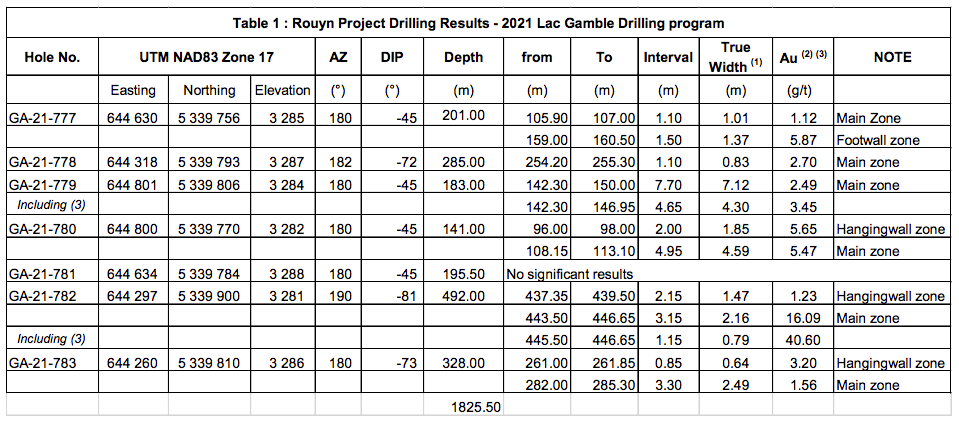

The Lac Gamble zone is located between the Augmitto and the Astoria deposits. The exploration target potential at Lac Gamble is interpreted to be between 400,000 and 600,000 ounces of gold at a grade between 7.0 and 8.5 g/t Au. The potential quantity and grade of the exploration targets referred to are conceptual in nature and insufficient exploration work has been completed to define a mineral resource. The property may require significant future exploration to advance to a resource stage and there can be no certainty that the exploration target will result in a mineral resource being delineated. The exploration targets are consistent with similar deposits in the area, deposit models or derived from initial drilling results.

IAMGOLD signed a definitive option agreement in December 2018, whereby IAMGOLD has the option to acquire a 100% interest in the Project by making scheduled cash payments totalling C$4 million and completing exploration expenditures totalling C$9 million over a four-year period. Exploration programs must include the completion of a minimum of 20,000 metres of diamond drilling within the first two years of the option. By the end of the expenditure period, IAMGOLD must complete a NI 43-101 compliant resource estimate, after which IAMGOLD, at its election, can purchase a 100% interest in the Project, subject to a 2% net smelter returns production royalty, by paying Yorbeau the lesser of C$15 per resource ounce or C$30 million. IAMGOLD is in the third year of the option agreement.

About Yorbeau Resources Inc.

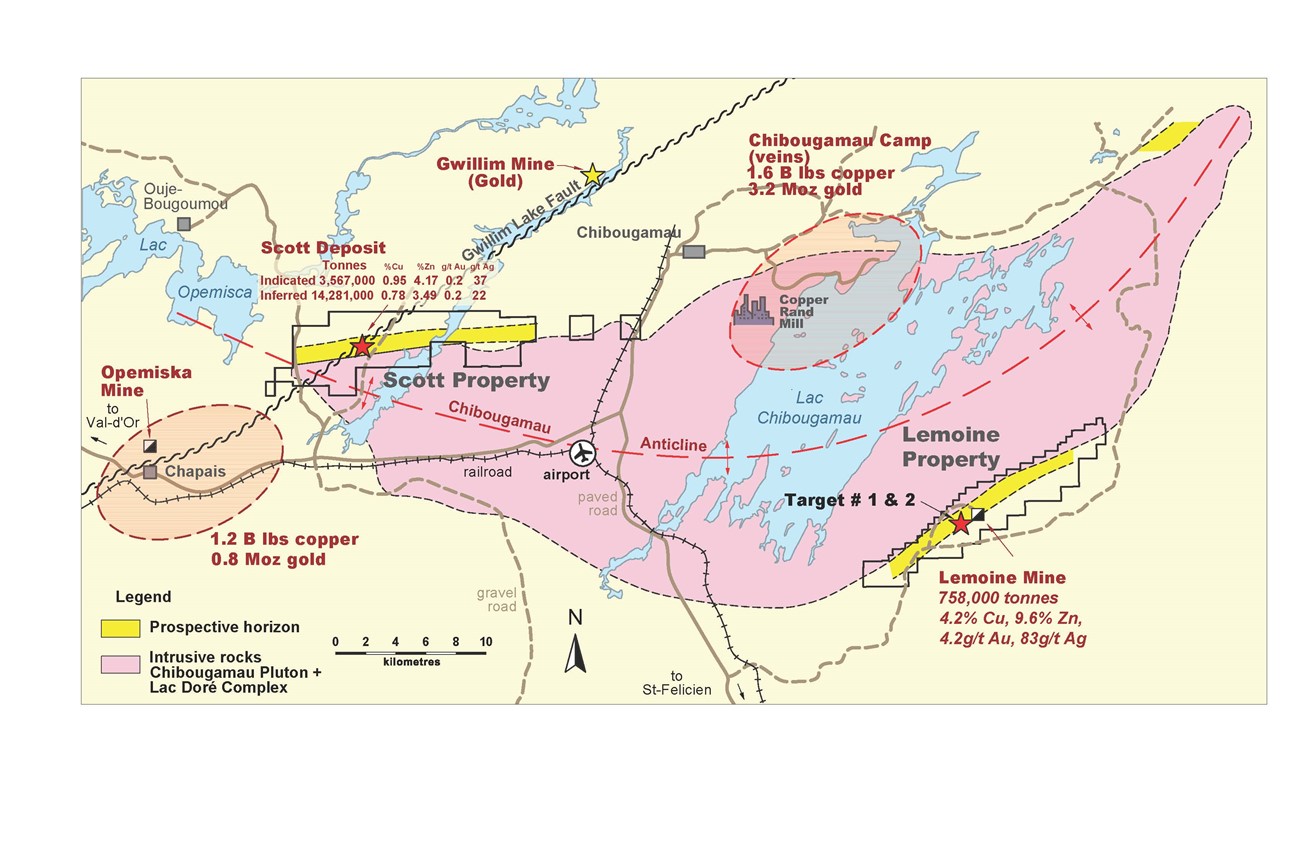

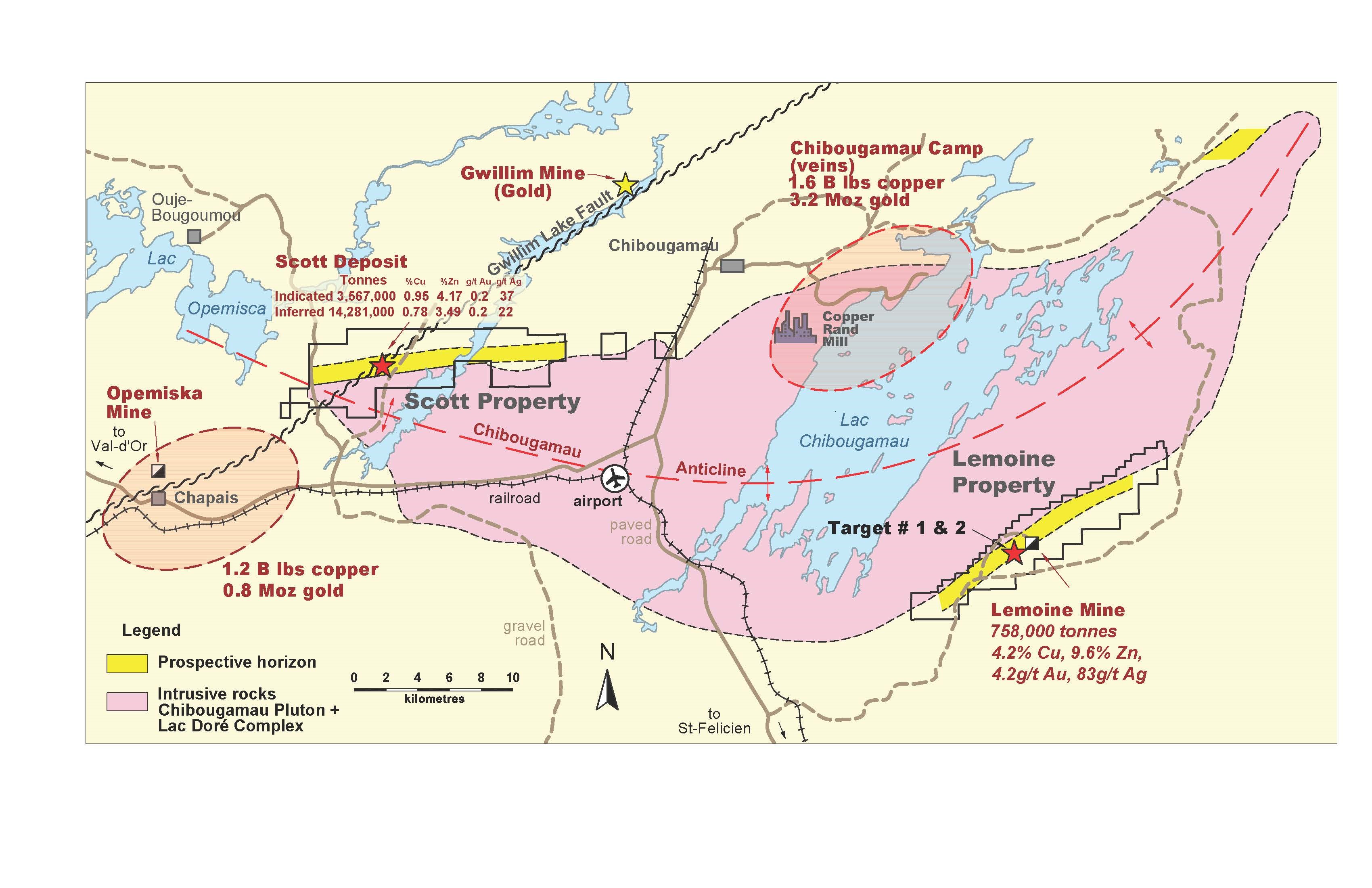

The Rouyn Property, wholly-owned by the Company, contains four known gold deposits in the 6-km-long Augmitto-Astoria corridor situated on the western portion of the property. The Company signed a definitive agreement in December 2018, whereby IAMGOLD has the option to acquire a 100% interest in the Rouyn property, and a major drilling program is underway. Two of the four deposits, Astoria and Augmitto, benefit from substantial underground infrastructure and have been the subject of technical reports that include resource estimates and that were filed in accordance with Regulations 43-101. In 2015, the Company expanded its exploration property portfolio by acquiring strategic base metal properties in prospective areas of the Abitibi Belt of Quebec that feature infrastructure favourable for mining development. The newly acquired base metal properties include the Scott Project, which bears important mineral resources (see the press release dated March 30, 2017) and on which a positive Preliminary Economic Assessment was recently completed.

For additional information on the Company, consult its website at www.yorbeauresources.com.

For further information, please contact:

G. Bodnar Jr.

President, Chief Financial Officer

Yorbeau Resources Inc.

gbodnar@yorbeauresources.com

Tel: 514-384-2202

Toll free in North America: 1-855-384-2202

Forward-looking statements: Except for statement of historical fact, all statements in this news release, including without limitation, regarding the prospects of the Rouyn project, drilling results, future plans and objectives are forward-looking statements which involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from those anticipated in such statements. Yorbeau disclaims any obligation to update such forward-looking statements, other than as required by applicable securities laws.