Yorbeau Issues Mineral Resources Estimates for its Wholly Owned Rouyn Gold Property Covering the Augmitto-Cinderella, Gamble and Astoria Zones

Home » Investors » News Releases » Yorbeau Issues Mineral Resources Estimates for its Wholly Owned Rouyn Gold Property Covering the Augmitto-Cinderella, Gamble and Astoria Zones

![]() Download PDF version | View all documents on Sedar

Download PDF version | View all documents on Sedar

Highlights:

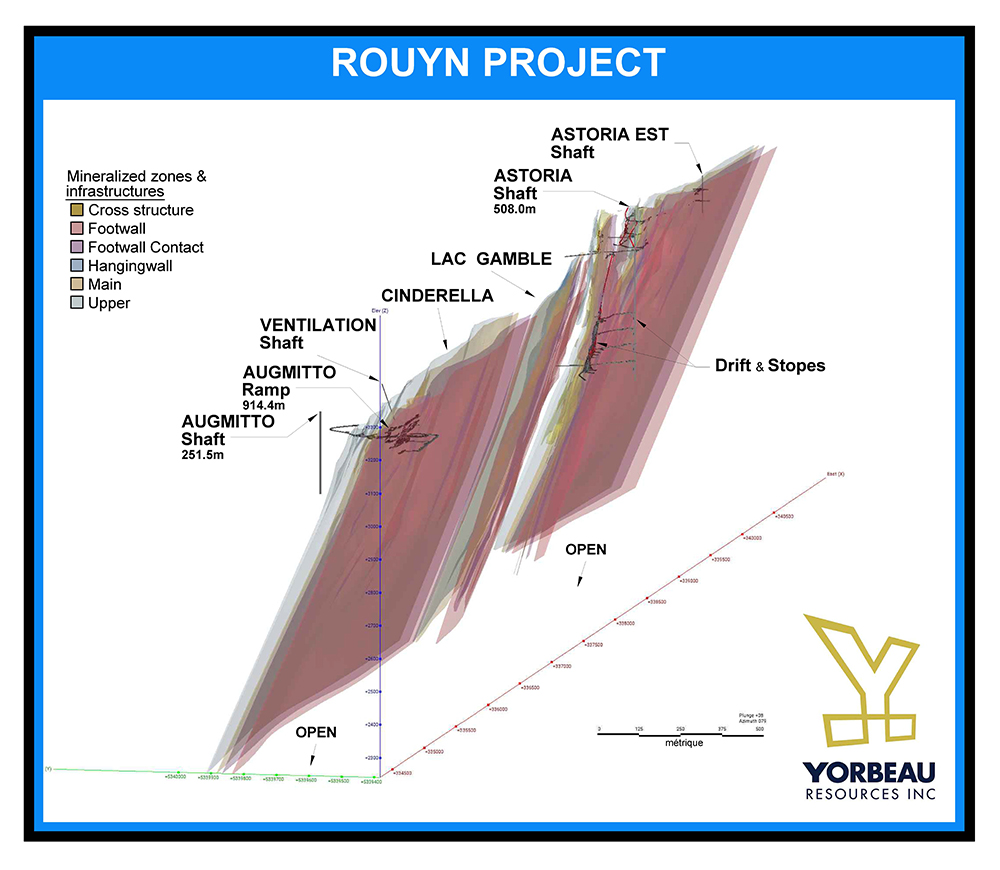

- Mineral Resources Estimates (“MREs”) issued for the Augmitto, Cinderella, Gamble and Astoria Deposits on a total of 22 gold-bearing lenses to a maximum depth of 900 meters.

- MREs in the Indicated Resources are 8.29Mt @ 3.44 g/t gold (918,000 ounces of gold)

- There are additional Inferred Resources of 5.778Mt @ 3.31 g/t gold (615,000 ounces of gold)

- Gold price = US$1,750.00/oz; USD: CAD exchange rate = 1.30.

MONTREAL, April 25, 2023 (GLOBE NEWSWIRE) -- Yorbeau Resources (TSX: YRB), (“Yorbeau” or the “Company”) is pleased to announce the release of new Mineral Resources Estimates (“MREs”) for its wholly owned Rouyn Gold Property (“Rouyn” or the “Property”), in the Rouyn-Noranda Mining Camp, Québec.

The new resources are 918,000 ounces of gold within the Indicated Resources category and 615,000 ounces of gold within the Inferred Resources category. The Property MREs were independently prepared by InnovExplo Inc., in accordance with National Instrument 43-101 (“NI 43-101”) and is dated April 18, 2023.

Terry Kocisko, Director & CEO states: “The Rouyn Gold Property has exceeded our expectations showing significant gold resources of more than 918 000 ounces indicated and 615 000 ounces inferred. The current Resources Update also demonstrates the potential for continued growth at Yorbeau. Given the success of our drilling at our Scott Lake VMS Project near Chibougamau, the success at Rouyn leaves the door open to increase the size of our MREs overall in precious and base metals as we continue to successfully advance our projects through 2023.”

George Bodnar, President & CFO, adds: “The new MREs at Rouyn include resources from the Augmitto-Cinderella, Gamble and Astoria Deposits covering a total of 22 lenses over a 6km trend to a depth of 1km along the Larder Lake-Cadillac Break. Geological expertise gained over the last 20 years along the Break indicates that the gold mineralization reaches depths of up to 3km, which leaves significant room for added gold potential at Rouyn. In the meantime, Yorbeau is assessing multiple scenarios to rapidly advance the Rouyn Gold Property towards eventual gold production.”

The final Technical Report (according to NI 43-101) will be filed with SEDAR within forty-five (45) days of the issuance of this news release. The report will be also available on Yorbeau’s website.

The MREs are outlined in the following table and notes:

| Deposit | Cut-off (g/t) | Indicated mineral resource | Inferred mineral resource | |||||

|---|---|---|---|---|---|---|---|---|

| Ultramafic hosted | Argillite hosted | Tonnage | Au(g/t) | Ounces | Tonnage | Au(g/t) | Ounces | |

| Augmitto-Cinderella | 2.05 | 2.2 | 1,769,000 | 3.65 | 208,000 | 940,000 | 3.17 | 96,000 |

| Astoria | 2.05 | 2.2 | 3,236,000 | 3.30 | 343,000 | 3,956,000 | 3.43 | 437,000 |

| Gamble | 2.05 | 2.2 | 3,285,000 | 3.48 | 367,000 | 882,000 | 2.92 | 83,000 |

| Total | 2.05 | 2.2 | 8,290,000 | 3.44 | 918,000 | 5,778,000 | 3.31 | 615,000 |

Notes to accompany the Mineral Resource Estimate:

- The independent and qualified persons for the mineral resource estimate, as defined by NI 43-101, are Marina Iund, P.Geo., Martin Perron, P.Eng. and Marc Beauvais, P. Eng. all from InnovExplo Inc. The effective date is April 18, 2023.

- These mineral resources are not mineral reserves, as they do not have demonstrated economic viability. The MREs follows CIM Definition Standards (2014) and CIM MRMR Best practice Guidelines.

- The results are presented undiluted, within underground constraining volumes (including ``must take’’ blocks and are considered to have Reasonable Prospect for Eventual Economic Extraction (RPEE).

- The estimate encompasses three (3) gold deposits (Augmitto-Cinderella, Astoria and Gamble) subdivided into 22 individual zones (4 for Augmitto-Cinderella, 14 for Astoria and 4 for Gamble).

- High-grade capping supported by statistical analysis was done on raw assay data before compositing and established on a per-zone basis varying from 25 to 100 g/t Au.

- The estimate was completed using sub-block models in GEOVIA Surpac 2021.

- Grade interpolation was performed with the ID2 method on 1.5 m composites for the Astoria deposit and the ID2 method on 1 m composites for the Augmitto-Cinderella and Gamble deposits.

- A density value varying from 2.75 to 2.87 g/cm3 (mineralized domains), 2.82 g/cm3 (unmineralized materials), 2.00 g/cm3 (overburden) and 1.00 g/cm3 (mined out) was assigned.

- The mineral resource estimate is classified as Indicated and Inferred. For the Augmitto-Cinderella and Gamble deposits, the Inferred category is defined with a minimum of two (2) drill holes for areas where the drill spacing is less than 80 m, and reasonable geological and grade continuity have been shown. The Indicated category is defined with a minimum of three (3) drill holes within the areas where the drill spacing is less than 50 m. For the Astoria deposit, the Inferred category is defined with a minimum of two (2) drill holes in areas where the drill spacing is less than 70 m, and reasonable geological and grade continuity have been shown. The Indicated category is defined with a minimum of three (3) drill holes within the areas where the drill spacing is less than 35 m. Clipping boundaries were used for classification based on those criteria.

- The mineral resource estimate is constrained in conceptual stope designs (Deswik’DSO). The consider mining scenario is long hole stope mining. It is reported at a rounded cut-off grade of 2.05 g/t Au (ultramafic hosted) and 2.20 g/t Au (argillite hosted). The cut-off grades were calculated using the following parameters: mining cost = CA$91.50; processing cost and transport = CA$35.00; G&A and environment = CA$15.00; refining costs = CA$6.55; selling costs = CA$15.30; gold price = US$1,750.00/oz; USD:CAD exchange rate = 1.30; and metallurgical recovery = 90% (ultramafic hosted) to 96% (argillite hosted). The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- The number of metric tonnes was rounded to the nearest thousand, following the recommendations in NI 43-101 and any discrepancies in the totals are due to rounding effects. The metal contents are presented in troy ounces (tonnes x grade / 31.10348).

- The authors are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, or marketing issues, or any other relevant issue not reported in the Technical Report, that could materially affect the Mineral Resource Estimate.

About Yorbeau Resources Inc.

Yorbeau Resources is a Canadian public company (TSX: YRB) involved in gold and base metal exploration in Quebec, Canada. Its properties are in northwestern area of the province containing many significant deposits on the famed Abitibi Greenstone Belt, including major gold mines along the Larder Lake- Cadillac Break and several volcanic centers hosting major copper-zinc-gold deposits.

Yorbeau is focusing on its Rouyn Gold and Scott Lake Zinc-Copper projects which have demonstrated the most immediate and substantial prospects for discovery and eventual mine development. While Scott is very favorably located in the Chibougamau mining camp, Rouyn represents a consolidation of several contiguous properties strategically located on the famously productive Cadillac Break in the Rouyn-Noranda Mining Camp. Other holdings of the Company include its interest in the past producing Joutel Gold Mining Camp and the Beschefer Property adjacent to SOQUEM’s B-26 deposit in the Selbaie Mine area.

Qualified Person

The scientific and technical content of this press release has been reviewed, prepared and approved by Mr. Laurent Hallé, Senior Mineral Exploration Consultant with Yorbeau, who is a “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Technical information related to the MREs contained in this news release has been reviewed and approved by Marina Iund, P. Geo., Martin Perron, P.Eng. and Marc R. Beauvais, P.Eng. of InnovExplo Inc., who are Independent and Qualified Persons as defined by NI 43-101, with the ability and authority to verify the authenticity and validity of this data.

For more information, please visit our website at https://www.yorbeauresources.com or contact:

G. Bodnar Jr.

President, Chief Financial Officer

Ressources Yorbeau Inc.

Tel: 514-384-2202

gbodnar@yorbeauresources.com

Laurent Hallé P. Geo

Consulting geologist

Yorbeau Resources Inc.

Tel: 819-629-9758

lhalle@yorbeauresources.com

Toll free in North America: 1-855-384-2202

Forward-Looking Statements: Except for statements of historical fact, all statements contained in this news release, including statements regarding future development and increase of the resources estimates, potential future production of gold at Rouyn and development of the Rouyn and Scott Lake projects and next development steps in connection with these projects, and future and objectives, are forward-looking statements that involve risks and uncertainties. There can be no assurance that these statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in these statements. Yorbeau disclaims any obligation to update these statements.