- Project indicates pre-tax IRR of 16.5% with an NPV8 of $144 million.

Montréal, November 20, 2017 - Yorbeau Resources Inc. (TSX: YRB) (the "Company" or "Yorbeau") is pleased to announce results of a Preliminary Economic Assessment ("PEA") prepared by Normand Lécuyer, P.Eng. and Jeff Sepp P.Eng. of Roscoe Postle Associates Inc. ("RPA").

Under the base case PEA the Scott mineralized material is fed to a new 2,500 tonne-per-day concentrator plant located at the mine site. Results indicate positive economics with a pre- production capital expenditure of $215 million, a net pre-tax cash flow of $516 million, an Internal Rate of Return ("IRR") of 16.5%, a pre-tax Net Present Value ("NPV") of $144 million at an 8% discount rate, and a mine life of 15 years. Tables 1, 2 and 3 show summaries of LOM estimated project capital costs and operating costs for the base case scenario.

Table 1: Scott Project Preliminary Economic Assessment Highlights:

(based on US$1.30/lb Zn, US$3.50/lb Cu, US$23/oz Ag, US$1500/oz Au and Canadian dollar exchange rate of US$0.80) - all values in Canadian $'s unless noted otherwise)

| Base Case: All Ramp Scenario with New Concentrator at Mine Site |

| Net Cash Flow | - Pre-tax Net Cash Flow of $515.8 million |

| IRR | - Pre-tax IRR of 16.5% with a 6-year payback |

| NPV | - Pre-tax NPV(8%) of $144.0 million |

| Operating Costs | - Life of mine ("LOM") Opex Costs of $89.02/tonne mined (includes mining, milling, G&A and Environmental) |

| Capex | - Pre-production capital of $215.47 million,

- Sustaining capital cost of $113.2 million |

| Production (Payable) | Production annuelle de pointe

- Zinc (years 9 - 12) : 75 million lbs. Zn in 72,405 t of concentrate

- Copper (years 5 - 8) : 15 million lbs. Cu in 28,467 t of concentrate

- Silver (years 5 - 8) : 395,835 oz in Cu concentrate |

| Mine Life | - Planned mine life of 15 years |

| LOM Mill Feed | - Estimated Plant Feed of 12,024,000 tonnes grading 4.14% Zn, 0.81% Cu, 26.59 g/t Ag and 0.24 g/t Au over LOM |

| Mill Recoveries | - Average LOM recoveries : Zn: 87% , Cu : 85%

- Ag : 45% reporting to the Cu concentrate,

- Au : 63% reporting to the Cu concentrate |

MINING AND DEVELOPMENT

The preproduction mine development is carried out by a mining contractor and turned over to the mine crews in year one. Contractor rates were used for the preproduction period while manpower estimates were made for the owner operators commencing in year one of the mine production. Although a shaft scenario was considered, an all ramp system was selected as the most appropriate and the mineralized zones are therefore accessed via a ramp system. The Scott Project will take approximately two to three years of initial development to prepare the mine for production. Mining during the LOM will include 50% mineralized material from Longitudinal LH stopes, 26% from Transverse LH stopes, 11% from Cut and Fill stopes, and 13% from development. The Stringer type mineralization will be mined using the Longitudinal stoping method and thus represents a large portion of the production profile.

RPA has used a sublevel interval of 20 m, as no geotechnical work has been completed to sufficiently assess the ground support requirements. There is an opportunity to potentially increase the sublevel interval however only for the Transverse stopes while maintaining good control of the mineralization limits and mining dilution. Once more geotechnical work is completed, level spacings may be increased, reducing capital and operating costs. The ramp option achieves production more quickly than a shaft option, however, peak production is not achieved for 4 years, and limited to 2,350 tpd, due to the development required to establish sufficient working levels.

PROCESSING

A concentrator would have to be built on site and the mill production mirrors the mine production. The mill feed would produce copper and zinc concentrates assumed to be commercially viable. Mill recoveries for the concentrates based on early metallurgical test work are shown in Table 1. The test work is considered incomplete and values for gold recoveries in the concentrate need to be verified. In RPA's opinion, additional testing of the massive sulphide material and the stringer material independent of each other are required to adequately understand the metallurgica l response and obtainable marketable concentrate products.

The recoveries used in this initial analysis and shown in Table 1 are based on the assumption of further optimization relative to metallurgical testing completed to date. The testing has indicated a high consumption of lime, required to adjust the pH values in the circuit. The limited testing will necessitate additional work to properly assess the processing cost from the point of view of reagent consumption.

Table 2: Scott Project Preliminary Economic Assessment - Operating Costs:

| Cost ($/t milled) |

| Mining | 54.14 |

| Processing | 27.49 |

| General & Administration | 7.40 |

TOTAL | 89.02 |

Numbers may not add due to rounding.

Table 3: Scott Project Preliminary Economic Assessment – Pre-production Capital Costs:

| $(millions) |

| Mining | 52.58 |

| Processing | 60.00 |

| Infrastructure | 15.78 |

| Tailings | 4.65 |

Sub Total | 133.01 |

| EPCM* | 46.55 |

| Contingency | 35.92 |

TOTAL | 215.47 |

*EPCM : Engineering Procurement Construction Management

Numbers may not add due to rounding.

RECOMMENDATIONS

Among several recommendations made by RPA, the following are of note :

- The Study is based in part on Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them. Therefore, additional in-fill diamond drilling to bring Inferred Resources to the Indicated category is required before further economic studies are considered. Given the level of accuracy needed for the drilling, an underground exploration program may have to be considered.

- A preliminary evaluation of an all-ramp versus ramp and shaft modes of access showed that the shaft scenario would increase the daily mining rate while lowering the operating and sustaining capital costs, however, at the expense of higher pre-production capital expenses. Additional tonnage discovered at depth may give additional support to the shaft scenario and it is recommended to continue exploring the mineralized system at depth and in particular west of the Gwillim Lake fault.

- An underground exploration program, involving a ramp and drill accesses, would provide a head start on mine development, with a positive impact on project economics.

- The mine design and schedule were based on preliminary knowledge of ground conditions and rock mechanics. To support the next stage of mine design it is recommended to perform prefeasibility- level geotechnical studies, as part of the underground exploratio n program.

- Estimated mill recoveries for the concentrates are based on early metallurgical test work. The test work is still incomplete and additional testing of the massive sulphide mineralization and the stringer mineralization independent of each other are required to adequately understand the metallurgical response during processing of both types of mineralized material for the life of the mine and to obtain marketable concentrate products.

- Discussion with the Province of Québec and the Canadian Environmental Assessment Agency should be initiated to confirm Environmental Assessment (EA), permit and approvals requirements. Environmental baseline data collection and engagement with Indigenous communities should also be initiated.

"We are very excited about the results of the PEA study on Scott, which provides a strong, initial foundation for eventual development of a new mine in the Chibougamau camp." stated Dr. Gérald Riverin, Yorbeau's President. "The ideal location of the project in an area already blessed with all necessary infrastructure has led to maintaining infrastructure capital costs to a relatively low level when compared to similar zinc projects. The horizontal widths and favorable geometry of the mineralized zones support the use of low cost long hole mining methods which had a big positive impact on the results of the study. Yorbeau is now in a position to evaluate a number of options to develop the Scott deposit."

The project has been valued using a discounted cash flow (DCF) approach. This method of valuation requires projecting yearly cash inflows, or revenues, and subtracting yearly cash outflows such as operating costs and capital costs. At this early stage of the study, royalties and provincial or federal taxes have not been included. Cash flows are taken to occur at the middle of each period. The resulting net annual cash flows are discounted back to the first year of valuation, and totaled to determine net present values (NPVs) at the selected 8 percent discount rates. The internal rate of return (IRR) is calculated as the discount rate that yields a zero NPV. The payback period is calculated as the time needed to recover the initial capital spent.

For readers to fully understand the information in this news release, they should read the Technical Report supporting the PEA in its entirety, including all qualifications, assumptions and exclusions that relate to the PEA, which will be filed on SEDAR at www.sedar.com and on the Yorbeau Resources website at www.yorbeauresources.com within 45 days of the date of this news release. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

The PEA is considered preliminary in nature and includes economic analysis that is based, in part, on Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically to have the economic considerations applied to them that would allow them to be categorized as Mineral Reserves, and there is no certainty that the results will be realized.

Mineral Resources are not Mineral Reserves because they do not have demonstrated economic viability.

Qualified Persons

Work at Yorbeau is carried out under the supervision of Gérald Riverin, PhD, P. Geo. He is a qualified person (as defined by NI 43-101) and has reviewed and approved the content of this release. The Technical Report and PEA referred to in this press were prepared by Normand Lécuyer and Jeff Sepp. Both are employees of RPA and are independent of Yorbeau. By virtue of their education and relevant experience, they are "Qualified Persons" for the purpose of National Instrument 43-101. Normand Lécuyer and Jeff Sepp have read and approved the contents of this press release as it pertains to the disclosed mining, milling and cost estimate aspects.

About Yorbeau Resources Inc.

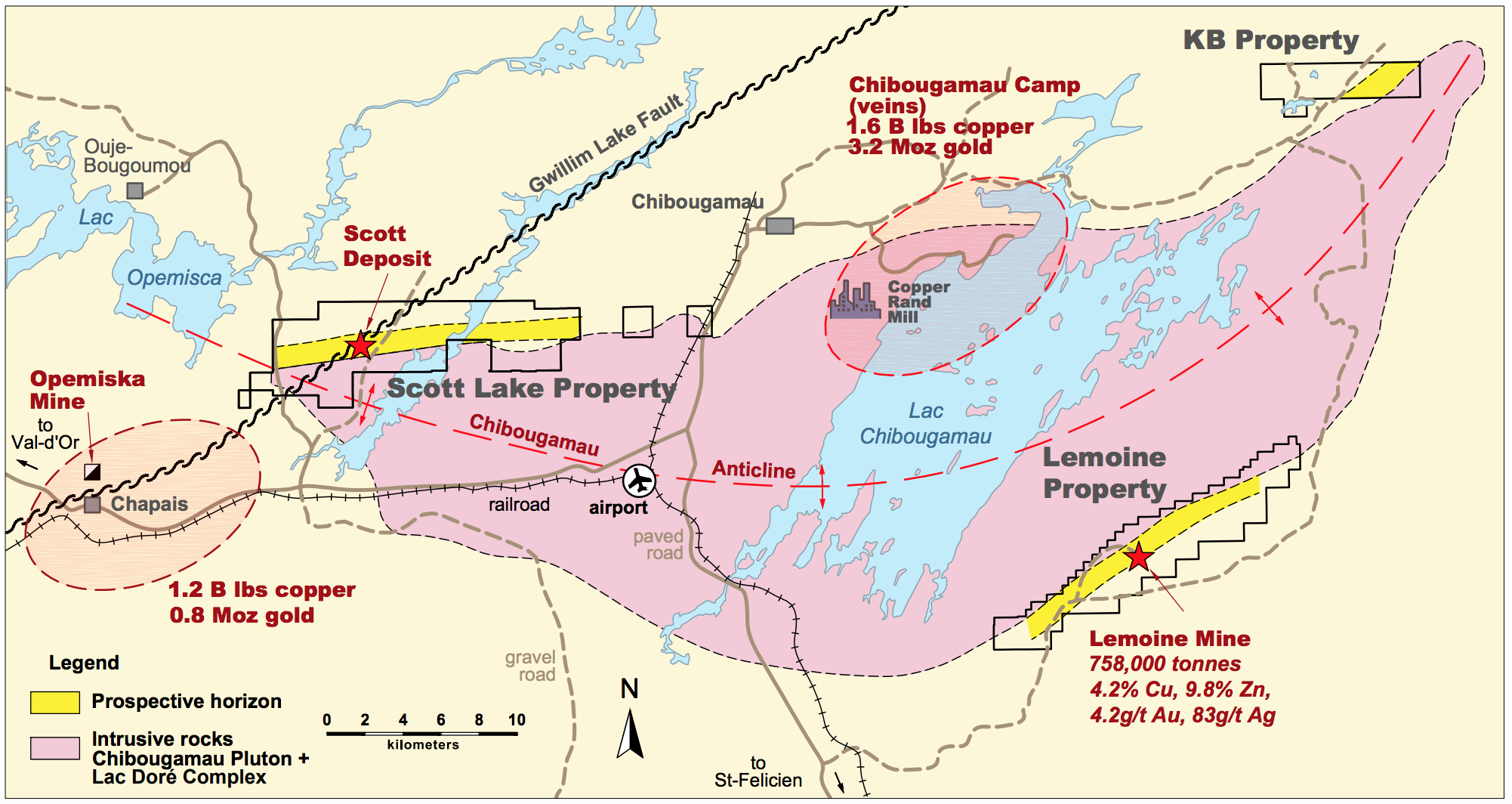

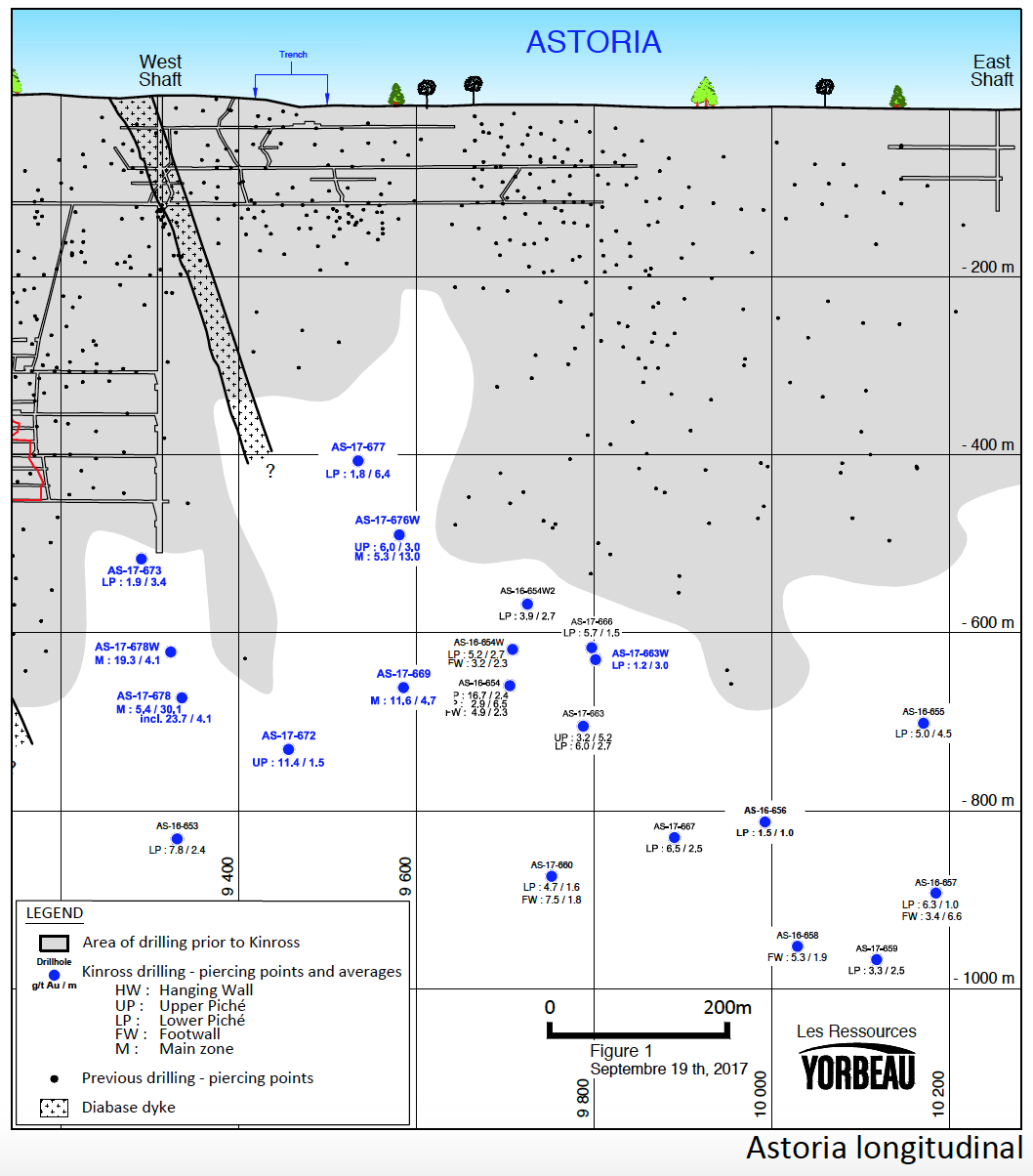

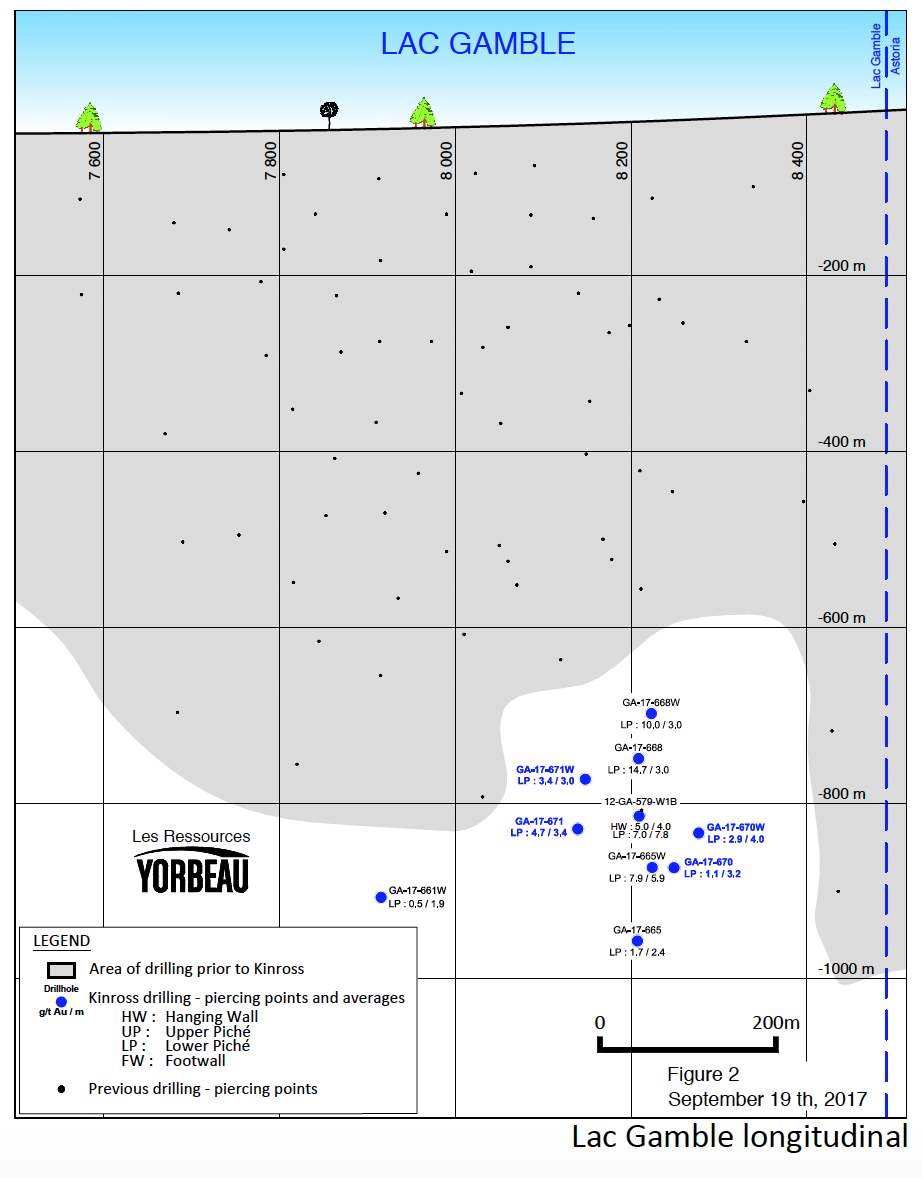

The Company's 100% controlled Rouyn Property contains four known gold deposits in the 6-km- long Augmitto-Astoria corridor situated on the western half of the property. Two of the four deposits, Astoria and Augmitto, have substantial underground infrastructure and have been the subject of NI 43-101 technical reports that include resource estimates. The Company has signed an Option Agreement with an affiliate of Kinross Gold Corporation to pursue exploration on the Rouyn Property (see press release dated October 25, 2016). In 2015, the Company expanded its exploration property portfolio by acquiring strategic base metal properties in prospective areas of the Abitibi Belt of Quebec and Ontario that also feature infrastructure favourable for mining development. The newly acquired base metal properties include Scott Lake which hosts important mineral resources.

More information on the Company may be found on the Company's website at www.yorbeauresources.com.

For further information, please contact:

Gérald Riverin, Ph D., P. Geo President

Yorbeau Resources Inc.

griverin@yorbeauresources.com

Tel : 819-279-1336

G. Bodnar Jr. Vice President

Yorbeau Resources Inc.

gbodnar@yorbeauresources.com

Tel.: 514-384-2202

Toll free in North America: 1-855-384- 2202

Forward-looking statements: Except for statement of historical fact, all statements in this news release, without limitation, regarding new projects, acquisitions, future plans and objectives are forward-looking statements which involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from those anticipated in such statements. The results of the economic analysis represent forward-looking information, as defined under Canadian securities laws, that is subject to a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those presented in the PEA. RPA is of the opinion that the accuracy of the results is in the range of industry wide commonly accepted scoping studies.

![]() Download PDF version | Views all documents on Sedar

Download PDF version | Views all documents on Sedar