Yorbeau Completes Sale of Rouyn Property

Home » news-releases » news-releases-2024

MONTREAL, Dec. 16, 2024 - Yorbeau Resources Inc. (TSX: YRB) (the “Company” or “Yorbeau”) is pleased to announce that it has completed the previously announced sale of its Rouyn property (the “Property”) to Lac Gold (Rouyn) Inc. (“Lac Gold”), a Canadian based subsidiary of Lac Gold Pty Ltd (Au) (the “Transaction”).

Pursuant to the Transaction, in consideration of a 100% interest in the Property, Lac Gold must pay a purchase price of C$25,000,000 to the Company as follows:

-

C$2,000,000 paid to the Company within 48 hours of signing the asset purchase agreement dated October 1, 2024 between the Company and Lac Gold (which amount was received by the Company on October 3, 2024);

-

C$3,000,000 payable to the Company on the closing date of the Transaction (which amount was received by the Company on the date hereof); and

-

three equal instalments of $6,666,666 payable to the Company on each of the second, third and fourth anniversary of December 10, 2024, collectively making up the C$20,000,000 unpaid balance of the purchase price, as evidenced by a promissory note issued on December 10, 2024 by Lac Gold to the Company carrying interest at a rate of 5% per annum.

The title to the Property was transferred to Lac Gold on December 10, 2024 upon the payment of the second tranche of C$3,000,000 and the satisfaction of other customary closing conditions. Lac Gold has until December 10, 2028 to pay the final instalment on the unpaid balance of the purchase price, but may accelerate any such payment. Lac Gold’s payment of the unpaid balance of the purchase price, together with accrued and unpaid interest thereon, is secured by a first-ranking hypothec on the Property.

In addition to the purchase price payable by Lac Gold, in connection with closing of the Transaction, Lac Gold issued and granted to the Company a 2% net smelter returns royalty on any minerals produced from the Property.

Yorbeau intends to use the proceeds from the sale of the Property to fund exploration programs and pre-development activities on its other properties, as well as for general corporate purposes.

About Yorbeau Resources Inc.

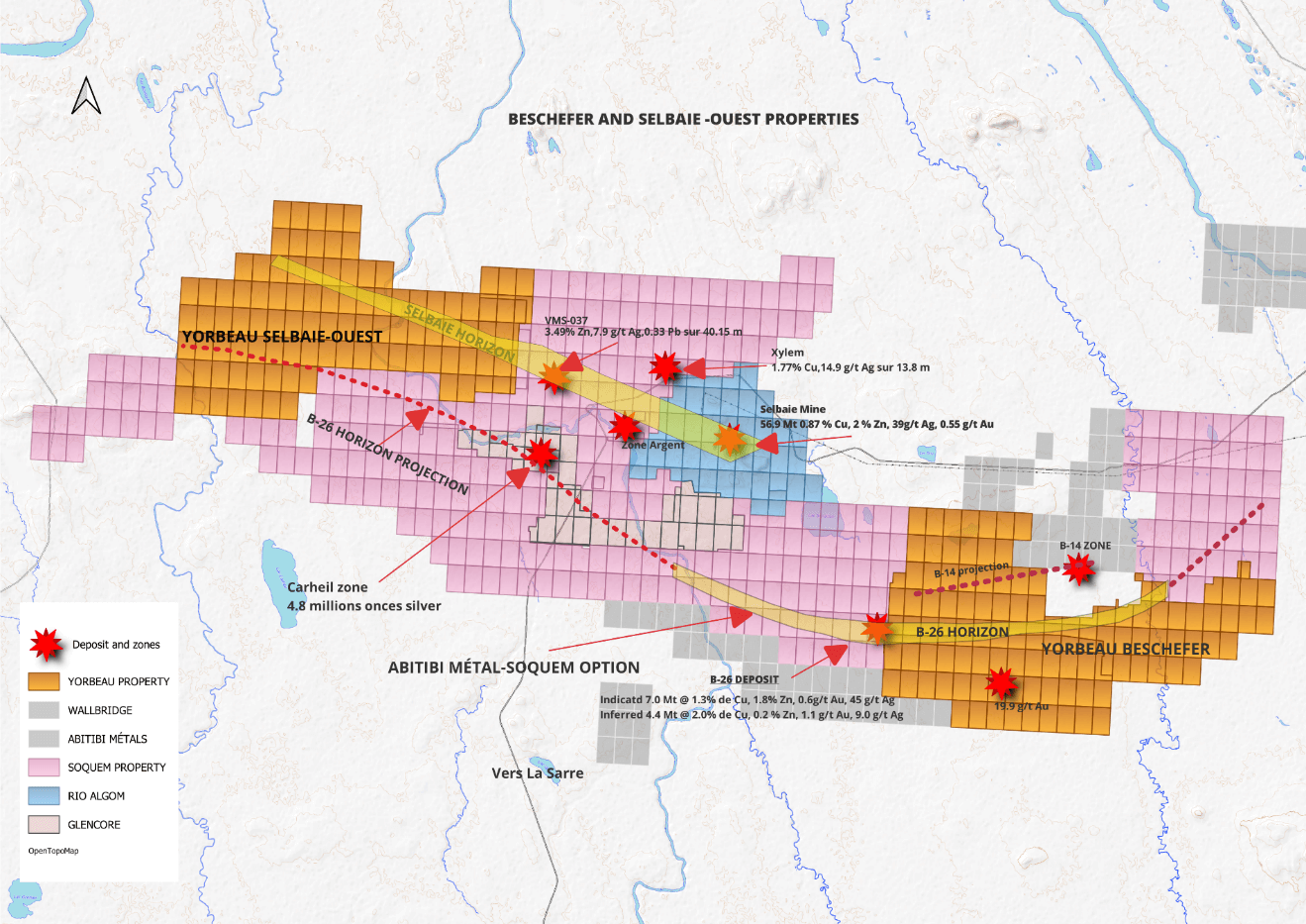

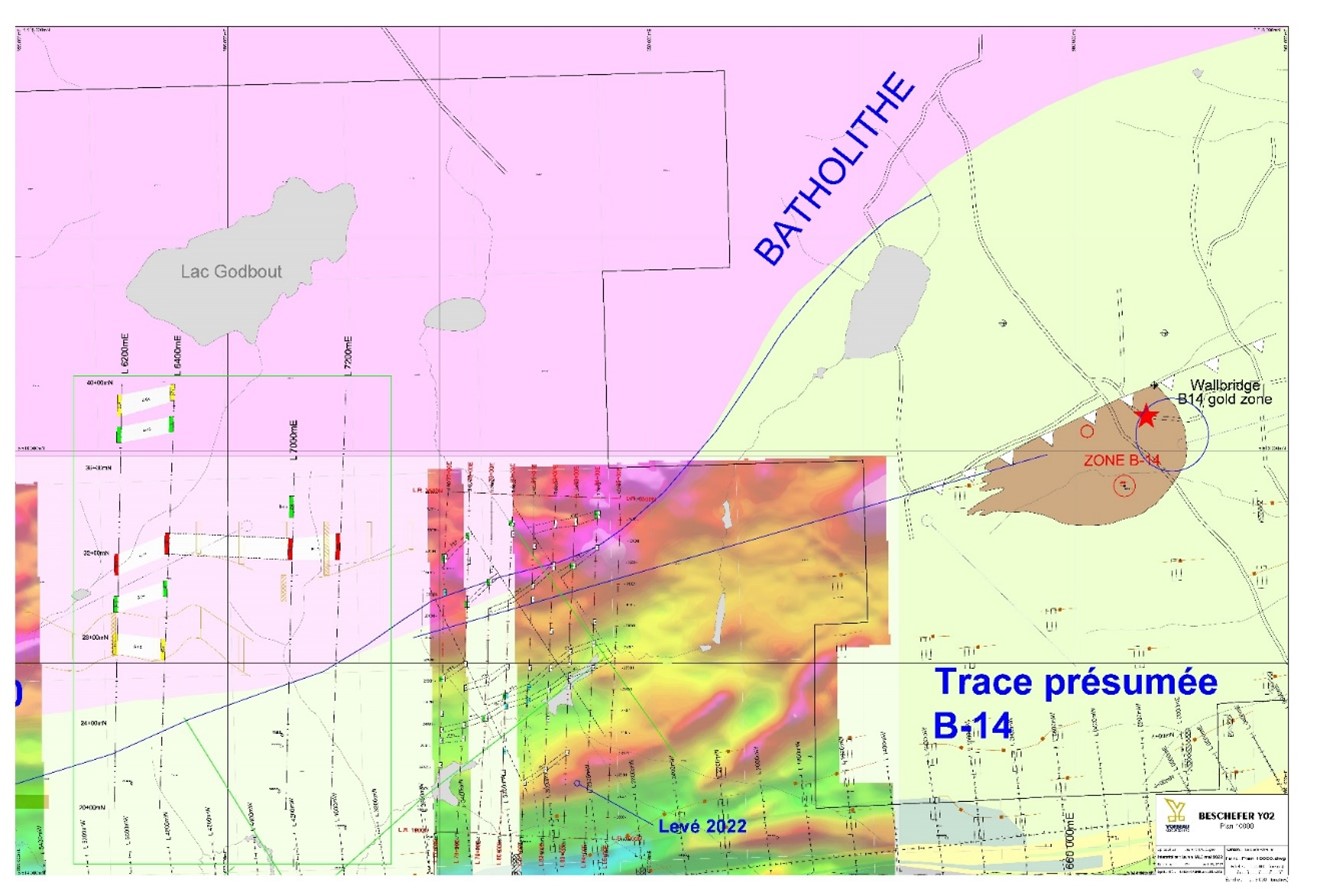

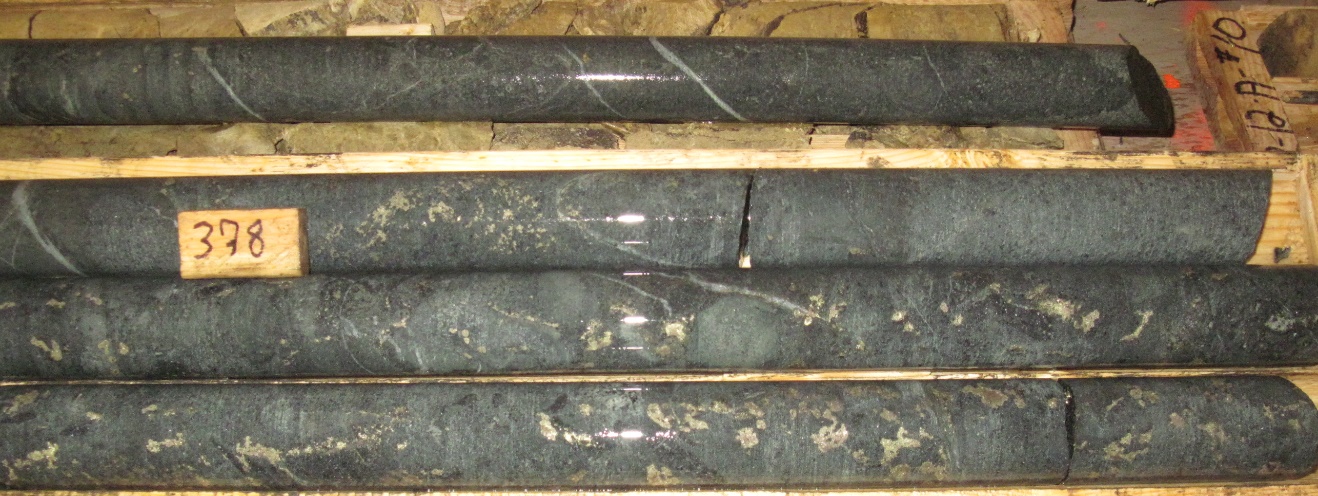

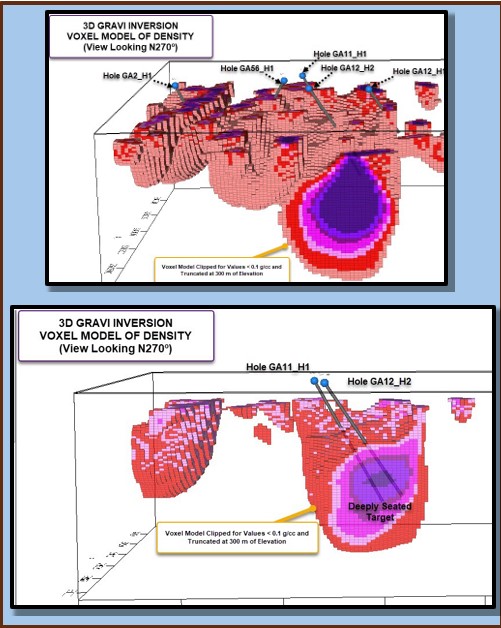

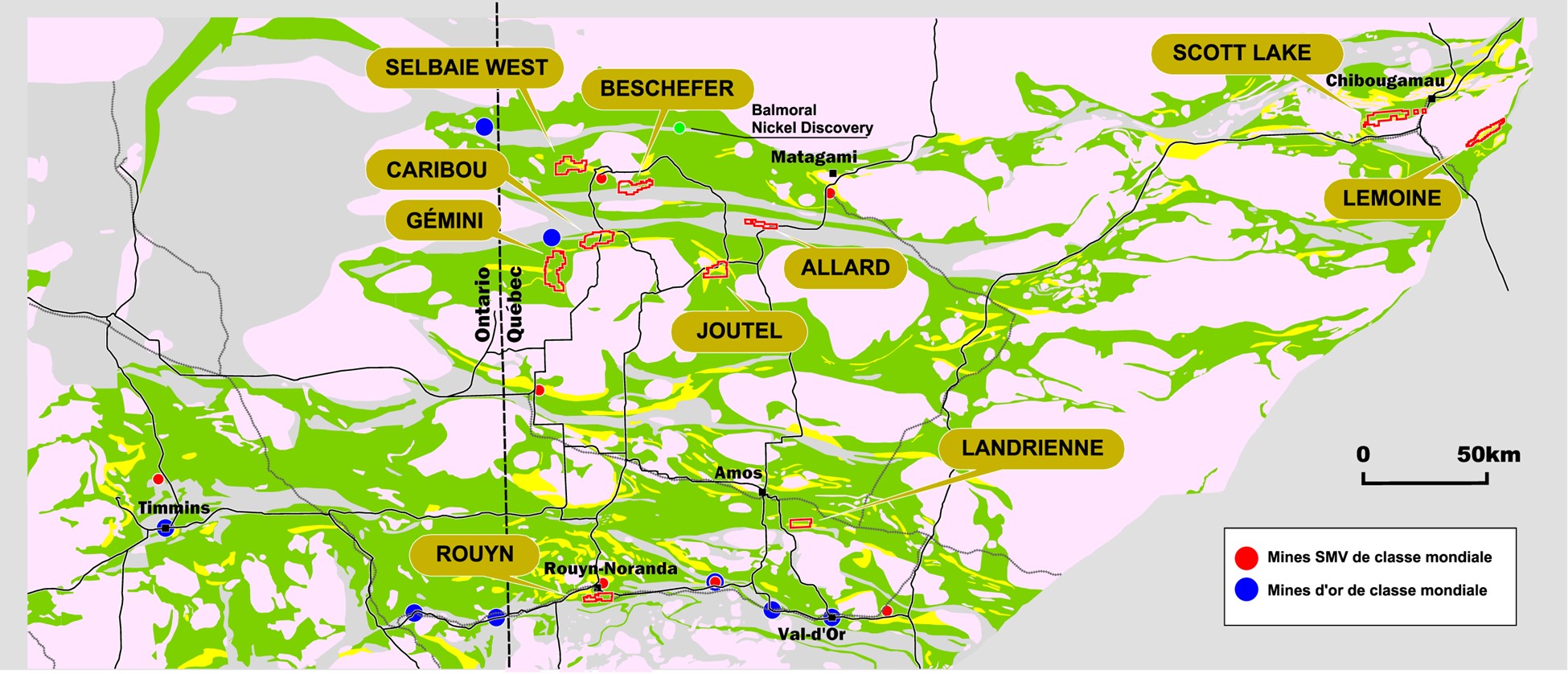

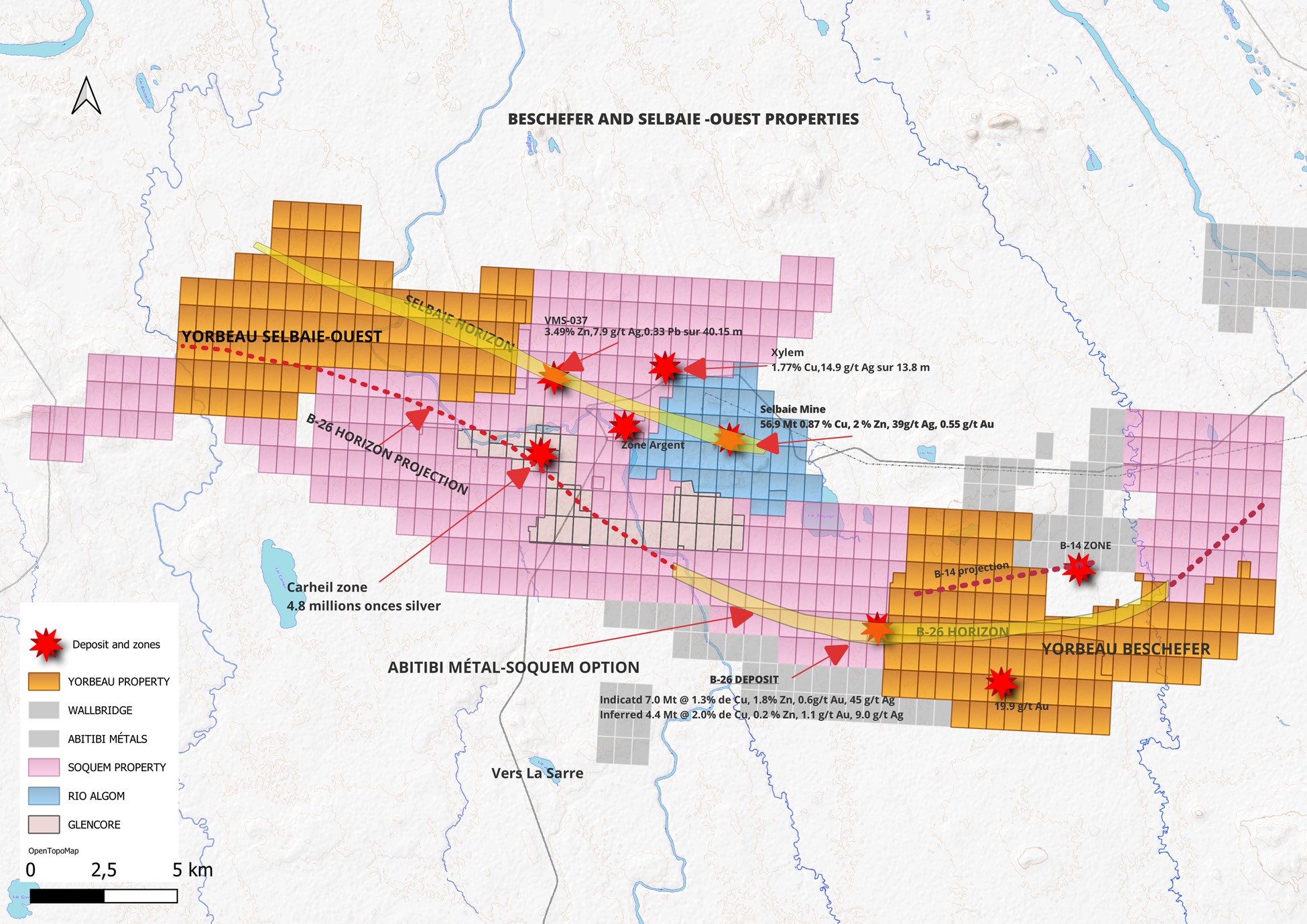

Yorbeau Resources is a Canadian public company (TSX: YRB) involved in gold and base metal exploration in Quebec, Canada. The Company’s focus is on seeking a partner to further explore and develop its Scott Lake zinc copper deposit near Chibougamau Quebec (refer to Yorbeau’s National Instrument 43-101 compliant technical report dated December 6, 2017, titled “Technical Report on the Preliminary Economic Assessment for the Scott Lake Project, Northwestern Québec, Canada,” available on the Company’s SEDAR+ profile at www.sedarplus.ca). Yorbeau also intends to focus on continuing exploration on its well-located properties in the Detour, Joutel and Selbaie region of north western Quebec. These properties include the Beschefer property which is adjacent to the B26 base metal deposit now being explored by Abitibi Metals Corp. and the Selbaie West property adjacent to Soquem (Wagosic property) where they are presently intersecting base metal values along the Selbaie mine horizon.

For further information, please contact:

G. Bodnar Jr.

President, Chief Financial Officer

Yorbeau Resources Inc.

gbodnar@yorbeauresources.com

Tel: 514-384-2202

Toll free in North America: 1-855-384-2202

Forward-looking statements: Except for statement of historical fact, all statements in this news release, including, without limitation, statements regarding the Transaction, payments in respect of the purchase price and the timing thereof, the Company’s intended use of proceeds, including any future exploration plans of the Company, and any statements regarding future plans and objectives, are forward-looking statements which involve significant risks and uncertainties. These risks and uncertainties include, but are not limited to, risks related to the payment of the unpaid balance of the purchase price and the timing of any such payments, failure to realize the expected benefits of the Transaction, risks related to Lac Gold, and the risk that the Property may not be developed or begin production in a timely manner, or at all. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from those anticipated in such statements. Yorbeau disclaims any obligation to update such forward-looking statements, other than as required by applicable securities laws.